Why Buy Land in Florida?

Florida offers diverse landscapes, from scenic waterfront properties to rural acreage perfect for building your dream home. The state’s favorable climate, no state income tax, and booming real estate market make it an attractive option for investors, retirees, and families looking to settle down. Common reasons people buy land in Florida include:

- Building custom homes

- Investing in real estate

- Agricultural and farming purposes

- Recreational use, such as hunting or camping

- Commercial development

Factors to Consider Before Buying Land

When purchasing land in Florida, it’s important to carefully evaluate several key factors to ensure the property aligns with your goals. First, consider the location, zoning, and land use. Each city and county in Florida has its own regulations regarding land use, which can impact whether the property can be used for residential, agricultural, commercial, or recreational purposes. Understanding these regulations before committing to a property is crucial.

Environmental considerations are also a top priority. Florida’s geography presents some unique challenges, including flood risks, hurricane exposure, and wetlands protections. It’s essential to research flood zones using FEMA’s Flood Map Service Center to determine if the property could be impacted by these natural events. Additionally, some areas of Florida may have stricter environmental regulations that could affect the use of the land.

Next, assess the accessibility and infrastructure of the property. This includes checking the availability of utilities like water, electricity, and sewer systems, as well as the ease of access via roads and proximity to services such as schools, hospitals, and shopping centers. Remote properties may require significant investment to establish the necessary infrastructure, so it’s important to factor this into your decision-making process.

Research and Due Diligence

Before finalizing your land purchase, conducting thorough due diligence is essential to avoid any surprises down the road. Start by verifying ownership and title history. A title search, conducted through a title company or local county records, will confirm that the seller has clear ownership and that there are no existing claims or liens against the property.

Next, be sure to check property taxes and HOA restrictions. Understanding the property tax rates will give you an idea of ongoing expenses, while checking for outstanding liens ensures that you’re not inheriting any financial obligations. If the land is part of a Homeowners Association (HOA), review any rules or fees that may impact your intended use of the property. Some HOAs enforce strict guidelines that could affect everything from land development to the types of structures allowed.

Finally, it’s crucial to understand land surveys and easements. A land survey will clearly outline property boundaries and identify any easements that may allow others to access parts of the land. Easements can affect future development, so it’s important to know if any third parties have legal rights to cross or use portions of the property.

Financing Options for Land Purchases

When it comes to purchasing land in Florida, you’ll need to decide whether to buy with cash or financing. A cash purchase offers a faster closing process, no interest charges, and fewer complications overall. However, if cash isn’t available, you can still move forward with financing options, which allow you to leverage borrowed funds for the purchase. Keep in mind, that financing a land purchase typically involves interest costs and specific loan requirements.

There are several loan options available for land purchases. Land loans are specifically designed for buying raw land, but they often come with higher interest rates, shorter terms, and larger down payments compared to traditional home loans. If you’re planning to build on the land, a construction loan may be an option. These short-term loans provide funds to finance the construction of a home on the property. In some cases, seller financing may be available, where the seller offers to finance the sale directly. This can be an attractive option for buyers who may not qualify for traditional loans, as the terms are negotiable.

Working with Real Estate Professionals

Navigating the land-buying process is much easier with the help of a real estate agent who specializes in land sales. Working with an experienced agent affiliated with KW Land® agent ensures that you have access to the right expertise when it comes to zoning, property values, and local regulations. A KW Land® member can help you navigate the complexities of land transactions, from finding the perfect property to completing all the necessary forms and paperwork.

When choosing a professional, make sure to find the right experts who are familiar with land sales in Florida. KW Land® members are well-versed in the nuances of land transactions and can offer invaluable guidance throughout the process. They can also connect you with other trusted professionals, such as title companies and surveyors, to ensure all your bases are covered.

In addition to working with agents, being prepared with negotiation tips can help you secure the best deal. Researching comparable land sales and understanding the local market is essential for negotiating a fair price. Don’t forget to factor in closing costs, potential development expenses, and any contingencies based on inspections and surveys.

Building on Purchased Land

Once you’ve secured your land, the next step is understanding the building permits and regulations in Florida. Before breaking ground, you must ensure that the property complies with local zoning laws and building codes. Each municipality may have different requirements for building permits, so it’s important to research these beforehand. Working with a local contractor or builder familiar with Florida’s specific regulations can save time and prevent costly mistakes.

Choosing a builder and designing your home are crucial steps in the process. Florida’s climate, including its high humidity and hurricane season, requires special consideration when selecting materials and building methods. Collaborate with reputable builders who are experienced in designing hurricane-resistant homes. It’s a good idea to have your home design finalized before you start searching for land, as this ensures your vision will fit on the property you purchase and avoids delays down the line.

Timelines and costs are also important factors to consider. Construction timelines vary depending on permits, availability of labor, and material procurement. Be prepared for additional costs related to land preparation, utility installation, and construction materials. Understanding these details upfront will help you better budget for the entire project.

Frequently Asked Questions About Buying Land in Florida

- How much do you have to put down to buy land in Florida?

Down payments typically range from 10-30% for land loans.

- Is it hard to buy land and build a house?

The process requires research, permits, and financing, but with expert guidance, it’s manageable.

- Does the bank provide loans for land purchase?

Yes however land loans often require higher down payments and shorter loan terms.

- How do I buy land in Florida?

Start by researching listings, conducting due diligence, securing financing, and closing the deal with a title company.

- How to find out if land is buildable?

Review zoning laws, conduct soil tests, perform topographical study, check wetlands map, flood zone and check for infrastructure access.

- What is the process of buying land in Florida?

- Identify potential properties

- Verify zoning and ownership

- Secure financing (if needed)

- Conduct inspections and surveys

- Negotiate and finalize the purchase

- Close the transaction

- Is it worth buying land to build a house?

Yes, if you value customization and long-term investment potential.

- What does unimproved and undeveloped land mean?

- Unimproved land: Lacks utilities or structures.

- Undeveloped land: May have some infrastructure, but is not fully ready for building.

- Why is land so cheap in Florida?

Prices vary by location, but rural areas tend to be more affordable due to fewer development opportunities.

- Can you buy land in Florida without being a resident?

Yes, non-residents can purchase land in Florida.

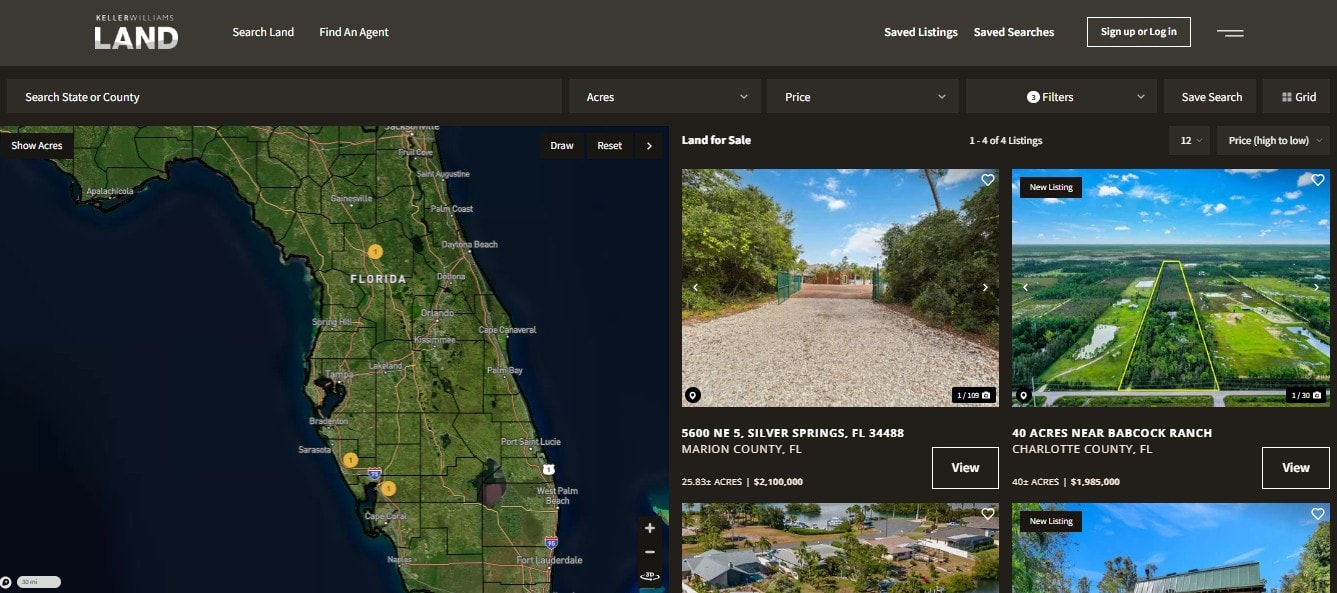

Discover Prime Florida Land for Sale and Start Your Search Today

Buying land in Florida offers excellent investment opportunities, whether for building a home, starting a business, or holding property for future value appreciation. By conducting proper research, working with experienced professionals, and understanding the financial aspects, you can make a confident purchase.

Ready to find your perfect piece of Florida land? Start your search today and connect with expert Florida land agents to guide you through the process!

Check out one of our featured listings in Silver Springs, FL on 25+ acres with 6 cabins and resort-style amenities. https://kwland.com/property/5600-ne-5-silver-springs-fl-34488-marion-florida/61647